T-Bills auction oversubscribed by 59% as interest rates fall to 28.29%

Interest rates on the yield curve decreased for the fifth consecutive week, as revealed by the results of a treasury bills auction conducted by the Bank of Ghana.

This decline follows the anticipated easing in January 2024 inflation, and the lowering of interest rates are expected to slightly reduce the cost of the government’s domestic debt.

The rate on the 91-day bill decreased by 30 basis points to 28.29%, while the 182-day bill experienced a decline to 30.79% from the previous week’s 31.09%.

The one-year bill also dropped to 31.39% from the preceding week’s 31.79%.

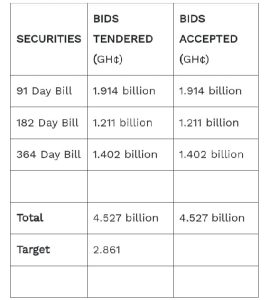

Despite falling interest rates, demand for T-bills remained high, with the government securing GH¢4.52 billion from the sale of short-term securities, representing about 58.26% oversubscription.

The majority of bids were for the 91-day bill, with an uptake of approximately GH¢1.914 billion, followed by the 364-day bill with a subscription of GH¢1.402 billion, and the 182-day bill with bids worth GH¢1.211 billion, all of which were accepted.

At its last monetary policy committee meetings, the Bank of Ghana announced that interest rates on the money market, “broadly trended downward at the short end of the yield curve” in 2023.

Governor Ernest Addison told journalists on Monday, 29 January 2024 that the 91-day and 182-day Treasury bill rates decreased to 29.49 per cent and 31.70 per cent respectively, in December 2023, from 35.48 per cent and 36.23 per cent respectively, in the corresponding period of 2022.

Similarly, Dr Addison said the rate on the 364-day instrument decreased to 32.97 per cent in December 2023 from 36.06 per cent in December 2022.

He reported that the interbank weighted average rate “remained well-aligned within the policy corridor by the end of 2023”.

The weighted average rate, he added, “increased to 30.19 per cent in December 2023 from 25.51 per cent in December 2022, in line with the monetary policy rate and supported by adjustments made in the cash reserve ratio”.

“The average lending rates of banks eased marginally to 33.75 per cent in December 2023 from 35.58 per cent a year earlier”, Dr Addison noted.

Meanwhile, base money growth “slowed down significantly through 2023 and was supportive of the disinflation process”, the Governor said.

He said: “Growth in reserve money defined to include currency outside banks and commercial banks reserves, slowed down significantly to 29.2 per cent by end December 2023 relative to a growth rate of 57.5 per cent observed in December 2022”.

The “sharp slowdown was driven in large part, by strong sterilisation efforts and effective liquidity management operations”, he noted.

He said: “With a tight monetary policy stance and increased risk aversion of banks due to rising credit risks, private sector credit expansion broadly remained sluggish in the year”.

Dr Addison added that in December 2023, “the pace of growth in private sector credit slowed to 10.7 per cent, compared with 31.8 per cent annual growth in December 2022”.

In real terms, he said credit to the private sector contracted by 10.2 per cent relative to a 14.5 per cent contraction, recorded over the same comparative period.